From side hustles to smart tech, here’s how a new system is allowing ordinary people to earn money without lifting a finger.

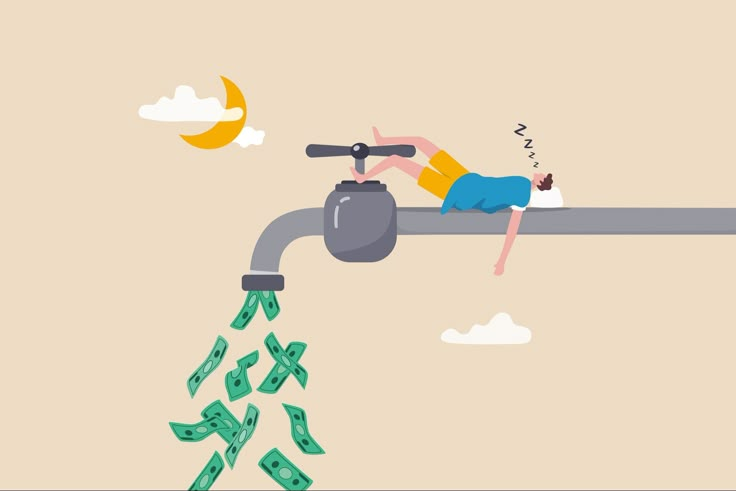

For decades, the idea of “making money while you sleep” has been a dream for millions. But in 2025, passive income is no longer just a buzzword — it’s a strategy reshaping how people approach financial freedom. At the heart of this shift is a new wave of automated, AI-driven platforms that are creating income streams with minimal effort, oversight, or risk.

One of the most talked-about tools in this new era? A platform called QuantumYield — a financial technology system that uses real-time data and quantum algorithms to automatically trade and grow users’ investments, even while they sleep.

The Shift: From Hustle Culture to Smart Automation

In the 2010s and early 2020s, passive income usually meant starting a blog, launching an e-book, or investing in rental property. While these methods can work, they often require upfront capital, time, and long-term maintenance.

But now, platforms like QuantumYield, Bruh AI, and Stoxible have introduced a hands-off method: users simply deposit a minimum amount (often as low as £250 or $300), set their preferences, and let the AI handle the rest.

“It’s like having a Wall Street analyst working for you 24/7 — without the salary,” says James Harding, a UK-based fintech advisor.

How Does It Work?

The core of these systems is AI-powered trading. Instead of manually buying or selling stocks, crypto, or other assets, the platform analyzes thousands of data points per second, looking for profitable opportunities across global markets.

The process looks like this:

- User deposits funds into a secured account.

- The system begins live trading, making dozens or even hundreds of micro-transactions.

- Profits are either withdrawn or automatically reinvested for compound growth.

Some platforms report average monthly returns of 20%–30%, although this varies with market conditions.

Real Users, Real Results

Sarah Mitchell, a 38-year-old accountant from Manchester, began using QuantumYield in late 2024 after reading a review online.

“I was skeptical,” she says. “But I put in £500 and didn’t touch it. After six months, my account had grown to over £2,100 — and I hadn’t lifted a finger.”

She’s now reinvesting her returns, aiming to reach £10,000 by early 2026.

Online forums and review sites like TrustPilot and Reddit are filled with similar stories — cautious optimism turning into surprise at just how smooth and effective these platforms have become.

Why Traditional Banks Are Nervous

Traditional financial institutions are watching this trend closely — and nervously. With interest rates still low and inflation high, many savings accounts barely keep up with the cost of living.

Meanwhile, AI-powered income tools offer an active return — without requiring users to manage complex investments or trust unpredictable stock tips.

“These platforms are essentially democratizing what hedge funds do for billionaires,” says economic analyst Lara Ng. “But now it’s available to everyday people.”

Is It Too Good to Be True?

As with any financial product, due diligence is essential. Not all platforms are regulated, and results vary based on market performance.

However, platforms like QuantumYield claim to work with licensed brokerages, implement bank-level encryption, and have passed multiple independent audits.

Users are advised to:

- Start small and test the system.

- Withdraw profits regularly or set up auto-withdrawals.

- Only use trusted platforms with a track record and public leadership.

What’s Next?

The rise of passive income 2.0 — powered by AI, quantum computing, and big data — suggests a future where financial growth doesn’t depend on constant hustle. Instead, it rewards those who leverage smart systems and make tech work for them.

As the global economy shifts, the smartest investors may not be the ones spending hours on charts — but those who simply knew where to plug in.

Interested in trying this method for yourself?

Platforms like QuantumYield and Stoxible are now accepting new users in the UK, EU, and select parts of the U.S. — often with a minimum starting balance as low as £250.

Passive income isn’t just a dream anymore.

It’s a system — and it’s working.